Your friend, who has never shown interest in cryptocoins before, is now arguing over the Ripple price predictions while sipping another pint of beer? It’s about par for the course. Digital currencies and blockchain technology are not just filtering into our life; they are storming into it on a tank, breaking the walls of obsolete foundations and prejudices.

In January 2017, while people were still trying to deal with the fact of Donald Trump being the winner of the presidential race, Bitcoin was dominating the cryptocurrency market with a solid 87% of overall capitalization. Over the past year, astronauts have been staring again and again at prices of BTC, ETH, LTC, DASH and many other coins through their portholes. The most popular cryptocurrency worldwide got several younger fork-brothers, while its market dominance slid towards 33%.

One would hardly claim that it is Bitcoin that made a step backward. No, the thing is that altcoins finally stepped out of the giant’s shadow and began to flourish under the sun of mainstream attention thanks to the regular and plentiful watering in form of sound investments.

Now, the entire world keeps a tab on Bitcoin Cash, Litecoin, Ethereum, Ripple, Monero, Stellar, NEO, Dash, OmiseGO, Tether, and other popular crypto assets. Some news about another industry giant collaborating with an altcoin that has been unknown until recently does not come as a surprise and is more of a pattern.

The top cryptocurrencies list allows you to monitor fluctuations in the price of various crypto assets in real-time. You can see market caps here, too, as well as draw conclusions relying on maximum and minimum prices of coins over the last 24 hours.

You can promote some little-known altcoin among your friends as much as you want, but it is a demand that determines its true popularity. It depends on many aspects with a few of them being more important:

The first point should not raise many eyebrows: when a virtual currency or token is vacuous and are without any real use, the demand will most likely be next to nothing. And if the transfers are fast, commission fees are low, while its price goes up day after day, the coin would gather a decent user base soon enough.

High spirits and craze work wonders. Internet media and even newspapers trumpet cryptocurrency news, schoolchildren tell each other swaggeringly how much money the “10% of pocket money” investments have brought, while your elderly neighbor is wondering whether it is possible to apply the blockchain technology to elections. You feel dizzy, your pulse gets faster, and you… go to sign up for an exchange account. Who knows, maybe the price will double by tomorrow!

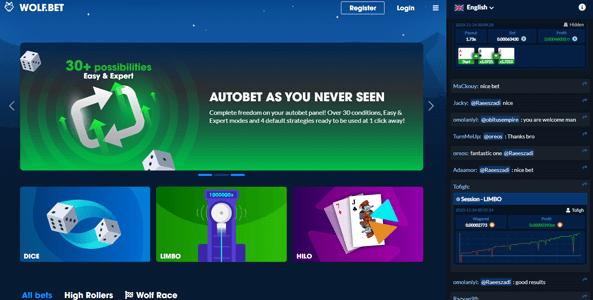

There is something to it that reminds gambling: the stories about early Bitcoin “investors” are similar to the tales about people who entered casinos with $20 in their pockets and hit the jackpots. The reaction can be the same in both cases: “If others did that, I might get lucky too. Especially now that I’ve read about all upcoming upgrades of this altcoin, not to mention the impending halving. I need to buy it!”.

The background of related news includes predictions about increases or slides in cryptocurrencies’ price. The CEO of JP Morgan Chase called Bitcoin a fraud that would burst soon enough? You’d better expect the price to go down. In 2022 leading financial experts predict $75,000, $100,000, or even $150,000 in a course of year? The demand will clearly increase, even if just for a while. And how about your own expectations?

The desirability of a cryptocoin might also be determined by a certain peculiarity, important only for some people. Monero, Dash, and Zcash are well-appraised due to the increased anonymity when sending money ― gamblers appreciate that as well. Dogecoin touches those who have been growing up with memes and liked Doge pictures. Every popular crypto coin has some characteristic features that attract people’s attention.

First and foremost, the crypto assets’ price is determined by the supply & demand ratio. Limited supply is a key factor in cryptocurrency rate growth. If someone decided to burn a giant pile of dollars, the US Federal Reserve would print some more. However, if you forget the password and mnemonic phrase for your personal Bitcoin wallet, the funds will stay there forever. According to some estimates, there are roughly two to four million BTC that are deemed lost. It reduces the actual supply, which eventually leads to an increase in price.

Apart from that, prices go up and down due to:

- Technological breakthroughs

- Involvement of new organizations

- Comments of people that are important for the industry

- Investments

- Actions of SEC or other regulators worldwide

- The inflow of new users

- Market liquidity

- Many other things

Prices of cryptocurrencies affect each other as well. It is especially true when it comes to the rates of altcoins against Bitcoin and Ethereum.

Everyone who is interested in crypto coins is fed up to the back teeth with the term “volatility”. That’s just the way things are: frequent and abrupt changes in cryptos’ prices have become their integral part. When being asked about cryptocurrency forecasts, many financial experts answer quite honestly: “nobody knows”.

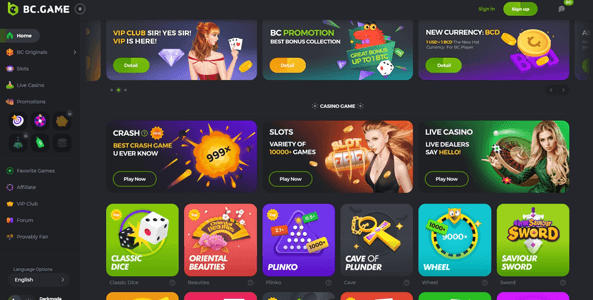

First things first, you should understand which benefits of coins are the most important for your gambling.

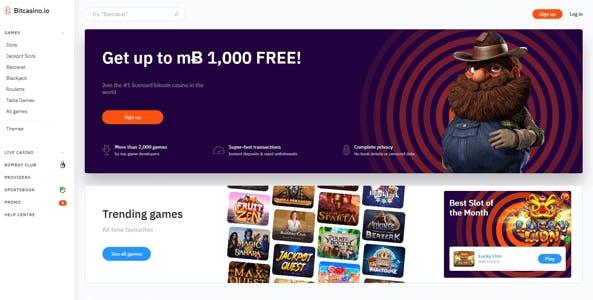

If you put anonymity first, there is a reason to look closely at Dash, Zcash, and Monero. Online casinos have first-hand knowledge of them (especially the latter), while these cryptos are also prospective and reliable.

Do you want to send funds quickly? Pay attention to Ripple, Litecoin, or Dash. Each one of them offers faster transactions if compared with others.

Perhaps, you would have some personal reasons to pick out a cryptocoin to gamble in poker, roulette, blackjack, slots, and so on. Dogecoin will be to the taste of those who like to place visually “big” bets ― currently, you can exchange $13 for 1000 DOGE!

Bitcoin and Ethereum can offer a wider choice of best casinos and big bonuses because the gambling industry has already got used to them. And that doesn’t even include a whole bunch of other benefits.

If you want to gamble with something more exotic, you might like Stratis, an ambitious newcomer with its own advantages. It also applies to some other altcoins that begin to show up on cryptocurrency websites.

If one of the listed coins gets your nod, you can purchase it at one of the corresponding exchanges, where people buy and sell crypto assets.

Here is the list of several larger companies:

- Binance

- Bitfinex

- Bittrex

- Bitstamp

- EXMO

- HitBTC

- Kraken

- LiveCoin

- Poloniex

- Wex (formerly BTC-e)

- YoBit

Crypto exchanges trade various currency pairs, so your choice will depend on your location, the coin you need, and the money you use. Popular digital currencies are listed on the majority of exchanges, but many altcoins are traded only on some of them. The same applies to fiat money. You should find one on your own.

When your selection is narrowed to a few names, you need to analyze the commission fee, withdrawal limitations, deposit methods, and other info about their services.

Furthermore, it is crucial to understand why you are buying coins:

1. For gambling - in this case, the exchange will allow you to buy cryptocurrency, store it, and send it to an online casino address. It is important to take account of identity verification requirements, the amount of fee, and transaction processing speed.

2. For crypto trading - here, you should also pay attention to the presence of currency pairs you need and various options for traders, for instance, leverage trading and its rate.

The notorious volatility provides crypto traders with attractive opportunities, while also hiding serious risks. Before trading, you should learn all the basic information you can find. When you are ready, trade with the amount that you able to lose.

Crypto asset trading would be a pure gambling game if it were not for some objective reasons why prices increase and slide. These reasons can be news about an upcoming halving, important updates, forks, governmental indulgences or crackdowns, acceptance as a payment method, and so on.

Of course, you can take advantage of reputable experts’ opinions, blogs, and communication with other traders in making your forecasts. However, there is a human factor to it, so use your discretion.

Analyze the available information, listen to others, and draw your own conclusions. A down-to-earth approach could save you from bitter mistakes. Perhaps, you would manage to make a nice profit on the price jumps of Bitcoin, Ethereum, Ripple, and other coins. Good luck!